What Happens After Mutual Acceptance?

Inspection:

The Buyer's agent will contact me to coordinate an inspection time. You will need to be away from your home during this 2-4 hour window of time. Negotiations surrounding inspections are unique to each home, and we will address any issues as they arrive.

Appraisal:

The buyer's lender orders the appraisal, which is paid for by the buyer. If your property appraises below the sales price, then you have the following options:

1. Order another appraisal at your own expense

2. Accept the appraisal and adjust the sales price to match the appraisal

Underwriter:

With an approved appraisal, the Purchase and Sale Agreement is then sent to the lender's underwriter for final approval.

Escrow:

Upon approval, the lender sends the documents to Escrow. Escrow then prepares the documents for your signature.

Escrow is an impartial third party process in which documents and funds are deposited by buyers, sellers and lenders to facilitate the closing for a real estate transaction. Escrow is required to follow mutual written instructions from all parties. They will coordinate with the buyer, seller and lenders to obtain required signatures on all documents, work closely with the title officer to clear liens and encumbrances against the property and record the documents with the county. Escrow assures all parties to a transaction that no funds are delivered and no documents are recorded until all conditions in the transaction have been met.

Opening escrow is the first step in the closing process. Generally, to open escrow, the parties to a transaction deliver to an escrow company the earnest money check and the purchase and sale agreement, which outlines the transaction and provides the closing date, contingencies and financing details. Anyone involved in a transaction can "open the escrow" but generally your real estate agent will do so. In the case of a for-sale-by-owner or FSBO, the buyer, the seller or both may open escrow.

The Escrow Process

- The Purchase & Sale Agreement is reviewed by the Escrow Officer.

- The preliminary title report is obtained from the title company.

- Introductory escrow instructions are created and sent to the buyer and seller.

- Your lender is contacted by the escrow officer to obtain initial loan information.

- The title report is reviewed. Liens and/or encumbrances, if any, are cleared so that a clean title can be given to the new purchaser.

- Payoff figures are ordered on existing encumbrances to be cleared at closing.

- The loan documents are received, reviewed and prepared for signing.

- Legal documents which include: The Statutory Warranty Deed, Excise Affidavit, Settlement Statement and closing escrow instructions are prepared.

- Signing appointments are scheduled with the buyer and seller.

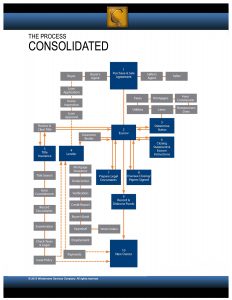

Click on the image below to view a larger view of the closing process.

Signing: At least 2 days prior to the closing date, the seller and the purchaser review the final documents. The purchaser's monies are deposited into the escrow trust account pending the closing date and the signed loan package is delivered by courier to the lender for final review. The Statutory Warranty Deed, Excise Tax Affidavit and Deed of Trust are delivered to the title company to hold for recording on the date of closing.

Closing: After the lender completes their review and wires the loan funds into escrow, legal documents are recorded. When recording is confirmed, the transaction is officially closed and funds are disbursed.

Finally, my favorite part of the process, I personally call you to inform you that your sale has been finalized!